457 b calculator

What may my 457b be worth. Second many employers provide matching contributions to.

14 859 Contribution Photos Free Royalty Free Stock Photos From Dreamstime

While there are similarities between a 457b and a 401k there are also key differences to keep in mind.

. In the US two of the most popular ways to save for retirement include Employer Matching Programs such as the 401k and their offshoot the 403b nonprofit religious organizations school districts governmental organizations. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change since 1987. Use this calculator to help determine if you are eligible for the 457b 3-year Special Catch-Up election and if so how much you can contribute to your employers 457b retirement plan in the current year.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. The limit for all savings to 457b plans is the lesser of 100 of the workers includable pay or the elective deferral limit. What is the impact of increasing my 457b contribution.

This calculator is intended for use by US. 457 Savings Calculator A 457 can be one of your best tools for creating a secure retirement. Budget Calculator Get your 503020 budget and then personalize it to your priorities and situation.

Gregorian date to Julian date. How much will you need in retirement. When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour options might include a 401k plan or a 457b plan.

In this section I will build a basic calculator that can perform the following operations. This 457 Savings Calculator is designed to help you make that prediction as accurately as possible. Here is a procedure to create a basic calculator.

It provides you with two important advantages. Calculators used by this calculator. Number of children under age 17.

Individual Its easy to enroll in your employers plan. OMNI clients have come to rely upon. You only pay taxes on contributions and earnings when the money is withdrawn.

Gregorian date to Roman calendar date. 457 Savings Calculator Overview. First all contributions and earnings to your 457 are tax-deferred.

What may my 457b be worth. My Retirement Overview Calculator Are you on the right track. 1 Work collaboratively with our clients to implement and maintain programs that enhance the perception of the 403b andor 457b benefit to increase participation.

And 457 Plans the Plans. Send your non-Pension Plus employees to our TDP calculator where they can weigh the cost of purchasing service credit. Financial Wellness Center MAC Calculator Contribution Guidelines.

Our Retirement Calculator can help by considering inflation in several calculations. Calculators that use this calculator. Our consulting services are designed to meet two primary goals.

B457b compliance and administration services TSACG and US. And 2 Ensure plans are structured and operate according to IRS requirements. When to Retire Staying on Track for Retirement.

What may my 403b Plan be worth. A 457b is similar to a 401k in how it allows workers to put away money into a special retirement account that provides tax advantages letting you grow your savings tax-deferred over time. Roth 401k 403b 457b Calculator Compare the financial differences of a Roth vs.

What is the impact of increasing my 457b contribution. Yes you can max out both your 401k and 457 plan up to the maximum allowed by the IRS which is 20500 for each account. What is the impact of increasing my 457b contribution.

What may my 403b Plan be worth. Day Link Save Widget. But predicting how much of a nest egg youll eventually be able to end up with is challenging.

Both plans allow you to contribute money towards retirement on a tax-deferred basis. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. This relationship also allows both teams to fully collaborate for the.

TDP Calculator-MPSERS site. View dates and times for scheduled maintenance. Determine if you are eligible for the 457b 3-year Special Catch-Up election.

Its important to create and monitor a savings strategy to reach your retirement income objectives. Deferred compensation plans are designed for state and municipal workers as well as employees of some tax-exempt organizations. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Solo 401k SEP IRA Defined Benefit Plan or SIMPLE IRA based on your income and age.

Comparing mortgage terms ie 15 20 30 years. Number of other dependents. The calculator will also help identify how much you may contribute under the Age 50 Catch-Up.

College Savings Calculator Saving for college is about planning and being prepared with a long term plan. The calculator converts a Gregorian date to a Julian date. A deferred compensation plan is another name for a 457b retirement plan or 457 plan for short.

This is a great way to maximize your tax advantages for those looking to quickly bulk up their retirement accounts. Your job income salary year. What may my 403b Plan be worth.

Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for small size or. The content on this page focuses only on governmental 457b retirement plans. A 457 savings plan is a great way to save for retirement if youre fortunate enough to qualify for one.

Contributing the max to both accounts results in a total tax deferral of 41000 per year not including catch-up contributions. The elective deferral limit for 457b plans is also 20500 for 2022 and 19500 for 2021. Start building on your retirement.

914 457 Images Stock Photos Vectors Shutterstock

Calpers Quick Tip Retirement Calculation Factors Youtube

Future Value Calculator

This Calculator Is Nerdy And Aesthetic Yanko Design Calculator Medical School Motivation Graphing Calculators

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Using A 457b Plan Advantages Disadvantages

A Guide To 457 B Retirement Plans Smartasset

Test Your Math Strength Against Former Pro Football Player John Urschel

Bmi Calculator By Life

Using A 457b Plan Advantages Disadvantages

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

What Is A 457 B Plan Forbes Advisor

457b Plans Non Qualified Deferred Compensation Plans Apa

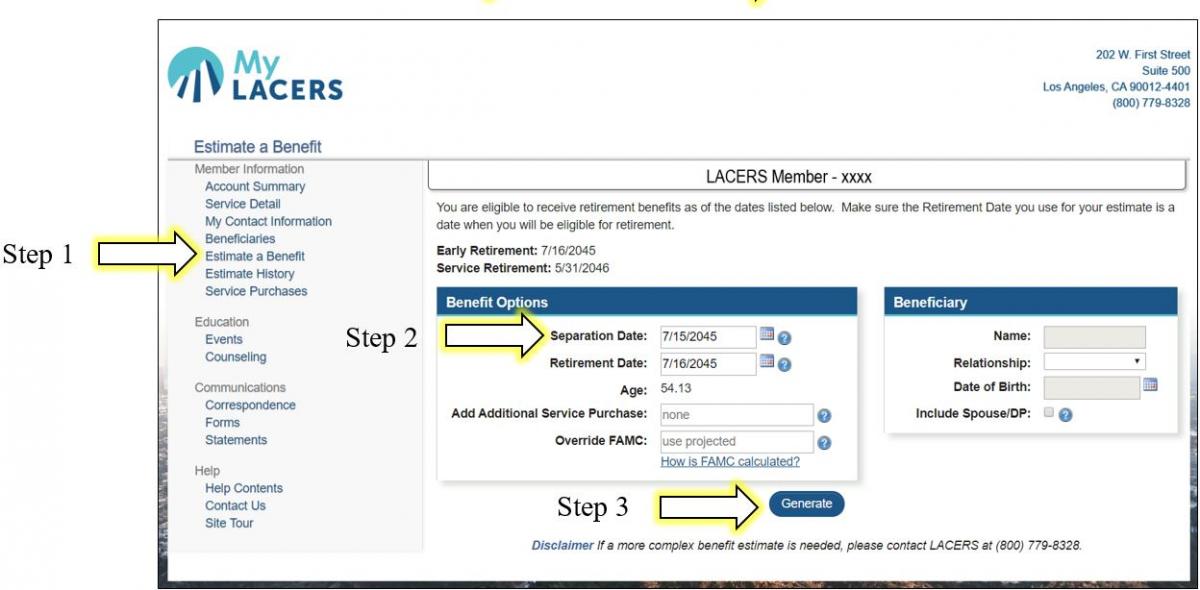

Explore Benefit Calculators Los Angeles City Employees Retirement System

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Retirement Savings Chart Retirement Calculator Retirement Savings Chart Savings Chart

Using A 457b Plan Advantages Disadvantages

Komentar

Posting Komentar